‘Puffery’ or illegal? State Supreme Court evaluates statements made by Denver energy corporation

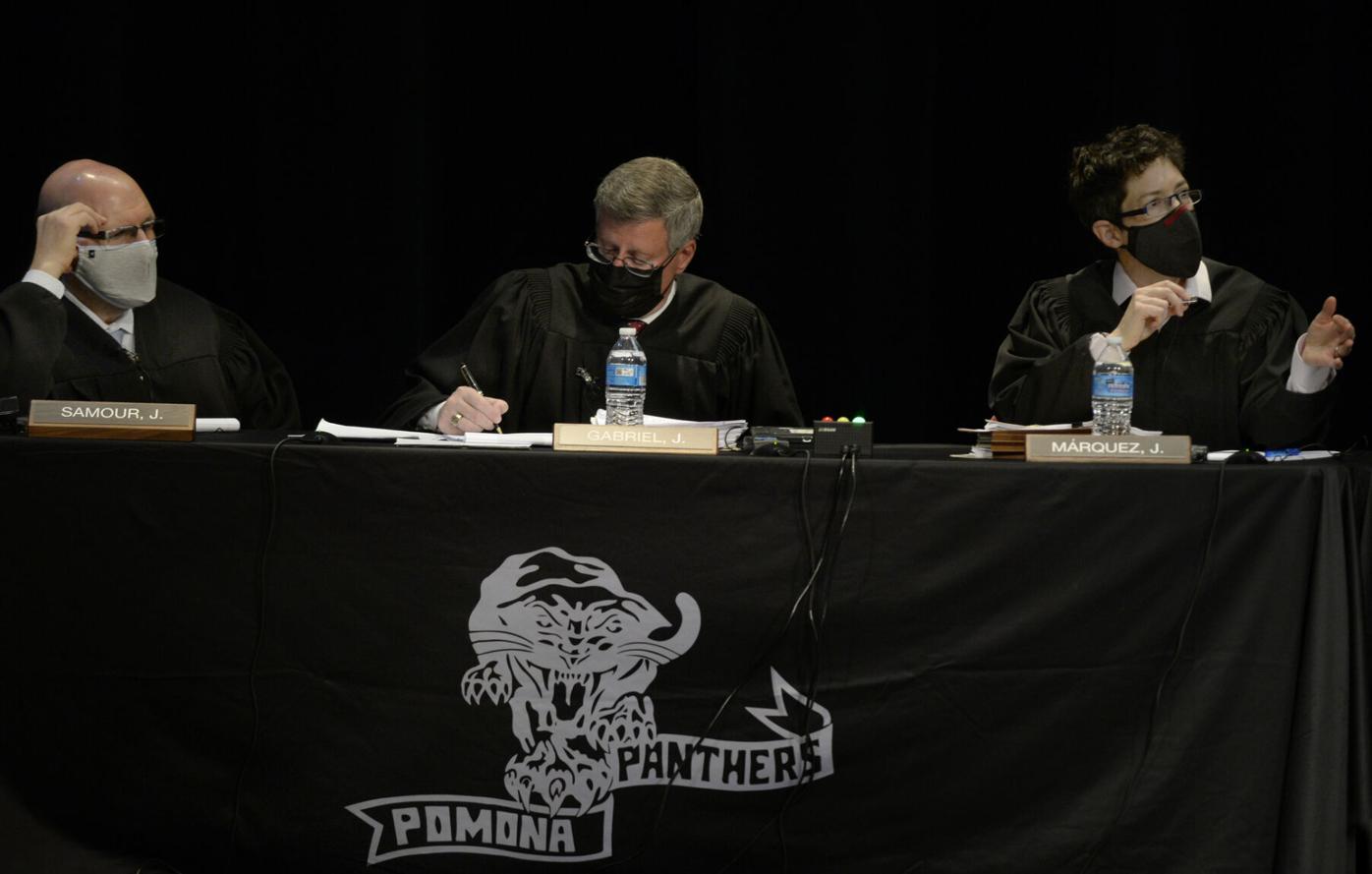

ARVADA, CO - OCTOBER 26: The Colorado Supreme Court, including left to right, justices Carlos A. Samour Jr., Richard L. Gabriel, and Monica M. Márquez, hear two cases at Pomona High School before an audience of students on October 26, 2021 in Arvada, Colorado. The visit to the high school is part of the Colorado judicial branch’s Courts in the Community outreach program. (Photo By Kathryn Scott)

Kathryn Scott

When Jagged Peak Energy Inc. began publicly selling shares of its stock in 2017, it allegedly misrepresented key aspects of its extraction operation to investors and overstated its ability to produce oil and gas.

Now, the Colorado Supreme Court will decide whether the 8,000-person Oklahoma Police Pension and Retirement System may sue Denver-based Jagged Peak under a Depression-era federal law intended to combat fraudulent corporate statements.

On Tuesday, the justices heard oral arguments in the OPPRS lawsuit after the state’s Court of Appeals determined last year that certain representations by Jagged Peak were not merely “puffery” — meaning optimistic statements that reasonable investors would not rely upon when making decisions. But rather, they were relevant, false expressions of the company’s abilities and expertise, a conclusion jagged peak disputed.

“When the statement is simply a generic statement that ‘we have an unspecified level of experience,’ the only objective assertion embedded in that is that the company has more than zero experience,” argued Paul H. Schwartz, an attorney for Jagged Peak.

Multiple members of the Supreme Court appeared skeptical.

“So, the binary is zero experience or, like, two minutes or more?” replied Justice Maria E. Berkenkotter.

At the heart of the appeal is a state appellate court’s interpretation of the Securities Act of 1933, which Congress enacted to require companies to disclose “material” information that would affect an investor’s evaluation of corporate stock.

In January 2017, Jagged Peak debuted its stock at $15 per share through an initial public offering. OPPRS was one of its investors. Shortly afterward, as the company performed poorly, OPPRS sued on the grounds that Jagged Peak allegedly overstated its ability to produce oil and gas through horizontal drilling in the Delaware Basin of west Texas. Specifically, OPPRS believed Jagged Peak misled investors about its ability to extract in the “core oil producing window” of the Delaware Basin and misstated the expertise of its workforce.

“Jagged’s two in-house geologists were inexperienced and incompetent,” OPPRS wrote in its proposed class action lawsuit, elaborating that one geologist was fired in mid-2017 and the other was in his first job out of college. “Another mistake was that Jagged frequently selected new drilling sites in close proximity to wells that had already collapsed. This was extremely poor judgment, since there was a high likelihood that drilling in those same ‘zones’ would yield similar results, given the almost identical geological makeup.”

The lawsuit did not describe the monetary damages to OPPRS from the alleged misrepresentations.

In July 2019, Denver District Court Judge Kandace C. Gerdes dismissed the entire lawsuit. She wrote that she could not find a violation of federal law in the company’s optimistic predictions to investors, noting that as “Plaintiff and Defendants are well aware, puffery and hopefulness are not actionable.”

But a three-judge panel of the Court of Appeals disagreed slightly with Gerdes. Specifically, the panel honed in on Jagged Peak’s statement to investors that it would “maximize returns by optimizing drilling and completion techniques through the experience and expertise of our management and technical teams.”

The appellate panel believed the company’s statement could be misleading to investors based on OPPRS’ allegations that Jagged Peak’s geologists were “inexperienced and incompetent” at the time of the initial stock offering, that the chief drilling executive had reportedly obtained drilling contracts favorable to himself, and that one particular contract provided a disincentive to tamp down costs.

Jagged Peak “was knowingly allowing inexperienced or incompetent employees to target well locations, it had awarded costly contracts to its contractors that motivated them to extend drilling times, and those contracts were allegedly awarded to benefit individual managers, not to save money and time,” wrote Judge David J. Richman in the April 2021 opinion.

In turning to the Supreme Court, Jagged Peak blasted the Court of Appeals for reading the vague and unverifiable “puffery” statements as being material to investors, contrary to the interpretations of federal courts. It cited the U.S. Court of Appeals for the 10th Circuit, based in Denver, which has delineated between “rosy affirmations” and “objectively verifiable” information. The company also alleged the appellate panel permitted OPPRS to pursue its claims based on events occurring after the time of the initial public stock offering.

Schwartz, the lawyer for Jagged Peak, emphasized the experience of the company’s geologists was inherently subjective and could not amount to a false statement.

“Why is that not objectively verifiable?” pushed back Justice Richard L. Gabriel. “When you say, ‘We’re gonna do great things through our very experienced staff,’ and there isn’t an experienced staff and you know it?”

“Are you saying any claim of experience will always be puffery because it can mean a range of things and can’t be verified?” added Justice Melissa Hart.

Justice William W. Hood III asked the attorney for OPPRS, Thomas L. Laughlin IV, to address the “scare tactics” raised in a brief supportive of Jagged Peak from the Securities Industry and Financial Markets Association, a trade group for investment banks and asset managers. The association claimed the Court of Appeals decision would transform Colorado into “a haven for plaintiffs filing weak securities” lawsuits.

“There’s a 50-page opinion from a three-judge panel that I think is consistent with federal law and looks like a decision you would get from a federal court,” responded Laughlin.

He elaborated that while a company’s claims to investors have to be verifiable, they do not necessarily have to be quantifiable with a “hard number.”

Justice Monica M. Márquez pointed out to Laughlin that Jagged Peak argued the Court of Appeals had improperly looked to factual statements in combination with optimistic, “puffery” comments in reaching its decision. Laughlin replied that context was key, as was the divide between what Jagged Peak promised at its stock offering versus what it actually did contemporaneously.

“If you say, ‘We have proven horizontal drilling experience in the Delaware Basin’ and your teams of people are going out and using the wrong mud mix and collapsing wells left and right and that’s leading to spiraling costs, that is misleading,” he said.

The case is Jagged Peak Energy Inc. et al. v. Oklahoma Police Pension and Retirement System.