Colorado Supreme Court rules commercial property owners not entitled to 2020 tax relief due to pandemic

RnJvbSBsZWZ0LCBDb2xvcmFkbyBTdXByZW1lIENvdXJ0IEp1c3RpY2VzIFJpY2hhcmQgTC4gR2FicmllbCBhbmQgTW9uaWNhIE0uIE3DoXJxdWV6IGFuZCBDaGllZiBKdXN0aWNlIEJyaWFuIEQuIEJvYXRyaWdodCBsaXN0ZW4gdG8gYW4gYXJndW1lbnQgZHVyaW5nIGEgQ291cnRzIGluIHRoZSBDb21tdW5pdHkgc2Vzc2lvbiBoZWxkIGF0IFBpbmUgQ3JlZWsgSGlnaCBTY2hvb2wgaW4gQ29sb3JhZG8gU3ByaW5ncyBvbiBUaHVyc2RheSwgTm92LiAxNywgMjAyMi4gKFRoZSBHYXpldHRlLCBQYXJrZXIgU2VpYm9sZCk=

UGFya2VyIFNlaWJvbGQ=

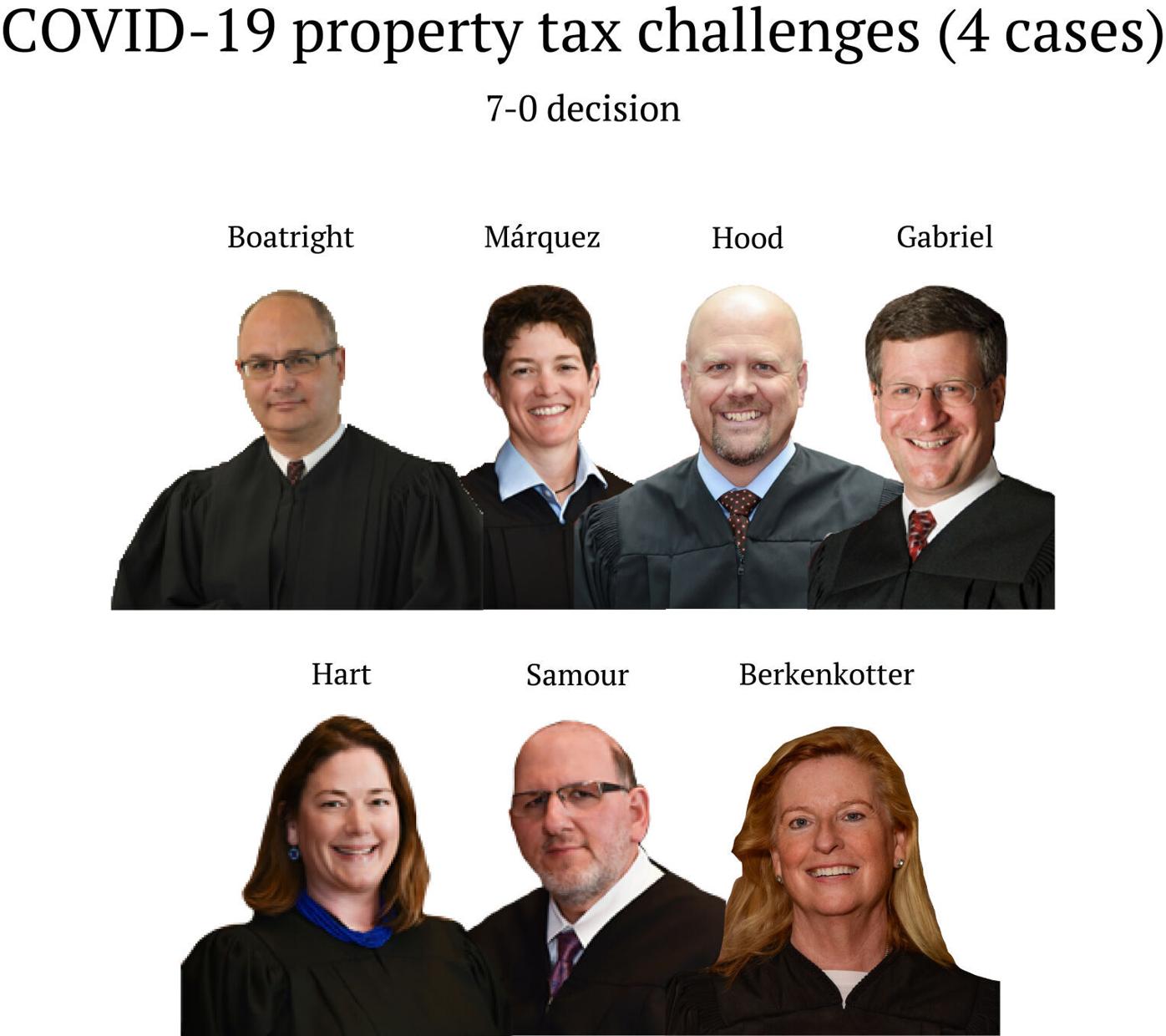

In four separate cases encompassing hundreds of commercial property owners, the Colorado Supreme Court on Tuesday ruled the COVID-19 pandemic and accompanying public health restrictions on businesses did not entitle the owners to a lower property tax bill for 2020.

Eleven lawsuits across Colorado challenged the decisions of county assessors who declined to re-value commercial properties for the 2020 tax year. The requests came as governmental regulations shuttered businesses, restricted capacity or otherwise attempted to control the spread of the novel coronavirus.

Colorado law does empower assessors to consider “unusual conditions” and regulations affecting the use of land, including “detrimental acts of nature.” Consequently, the Supreme Court agreed in a handful of cases to answer whether the COVID-19 pandemic fell into that category.

The answer is no.

“Whether COVID-19 is viewed as a virus or a pandemic, it did not resemble the natural events — earthquakes, floods, and tornados — that we consider acts of nature,” wrote Justice Monica M. Márquez. “COVID-19 may have infected people who were on the property. But COVID-19 did not infect the property itself.”

James P. Bick Jr., the Missouri-based attorney who represented the property owners through The Joseph C. Sansone Company tax firm, estimated the tax savings to his clients could have been in the millions of dollars had they prevailed.

In a related ruling, the court also clarified when county assessors may evaluate unusual conditions. Property tax assessments in Colorado operate on a two-year cycle in a backward-looking fashion. Property values for 2019 and 2020 were set on Jan. 1, 2019. The values came from data gathered between Jan. 1, 2017 and June 30, 2018.

The system means property owners will enjoy a lower bill if their property values increase after the data gathering period, while counties will benefit from more revenue if values drop after the same period.

Although it was possible for property values in 2020 to change from their 2019 amount due to unusual conditions in 2019, the COVID-19 health orders came exclusively after Jan. 1, 2020. Therefore, the effects of COVID-19 could play a role in property values for tax years 2021 and 2022 — but not 2020 itself.

The Supreme Court observed the frequent public health orders — some of which restricted business operations and others restored a semblance of normalcy — would make realtime calculations of property values impractical.

“And a volatile period in which certain businesses closed, then opened, then closed in response to rapidly changing public health orders, and which may or may not have decreased the value of the properties in which the businesses were located, would require near constant revaluation,” wrote Justice Maria E. Berkenkotter in a separate case.

Prior to the Supreme Court’s intervention, trial judges across the state had reached different conclusions about whether commercial property owners could petition county assessors for a reduction in their 2020 property values after the 2020 tax year had begun. Last October, the Court of Appeals issued a precedent-setting decision that assessors had to at least consider the impact of COVID-19.

In an unusual move, the appeals court then asked the Supreme Court to accept four nearly identical cases and decide, once and for all, what to do with the high volume of requests for tax relief.

Multiple counties wrote to the Supreme Court arguing the law does not require them to perform a “massive revaluation project” in a pandemic, or any comparable situation where the value of a property may fluctuate over a short window.

“A hotel of 120 rooms — if they remodel at a rate of two to three days per room, the assessor would have to go out every two to three days for the next 240 to 360 days and issue new assessments,” David P. Ayraud of the Larimer County Attorney’s Office told the justices in January. “Citizens have no idea what their tax burden is going to be because we’re constantly changing and updating it, and governments can’t plan for any of the critical services because they have no idea what the final outcome of their budgets will be.”

Bick countered the COVID-19 health orders were unique in that they drastically curtailed use of many businesses during the worst of the pandemic.

“When you have a regulation that closes your business or prohibits it from operating, that’s a regulation that restricts your use of land,” he said.

Some members of the court seemed unconvinced the public health orders limiting capacity or requiring mask-wearing amounted to unusual conditions restricting the use of real estate.

“How does a virus relate to property?” said Justice Richard L. Gabriel. “This is a virus of human beings.”

“Would the health department closing a restaurant be something requiring revaluation of the land, that shuts the business down?” added Justice Melissa Hart.

Ultimately, the Supreme Court decided the COVID-19 pandemic was unlike traditional disasters affecting property values — like floods or fires — in that it occurred everywhere and did not affect the property itself. Likewise, the court was unconvinced that regulations limiting the capacity of a store for health reasons necessarily changed the use of the land.

“If the COVID-19 orders were deemed regulations restricting the use of land because they required a temporary closure,” wrote Márquez, “then ordinary changes to fire codes affecting occupancy limits or even a routine public health order requiring the temporary closure of a particular restaurant would likewise amount to an unusual condition requiring revaluation of the property.”

Toby Damisch, the Douglas County assessor, expressed relief at the Supreme Court’s reading of the law. If the justices sided with the property owners, he said, “I believe it would have, in a single set of decisions, re-written Colorado’s entire property tax scheme.”